July 28, 2020 | 3 Min Read

Navigating the claims process is a daunting task for many consumers of insurance products. This is more so when the circumstances surrounding the process are often unexpected or are indicative of a loss or even a disaster. As an insurer, you may be constantly working to make the process more customer-friendly. The question then is, how are you letting your consumer know that it is simple?

Contrary to the belief, Creativity and Claims can go hand in hand

In an increasingly digital world, insurance brands need to market their processes and content creatively and contextually to deliver a stand-out customer experience. When you are dealing with sensitive and sometimes complex subjects such as claims, using visual aids go a long way.

Here are a few ways to enhance your messaging across social media, blog content and digital platforms in an accessible and visually appealing manner.

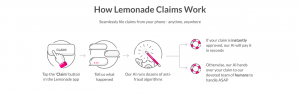

Infographics

No more texts! Posting aesthetically crafted and informative infographics on websites and social media profiles will provide easily consumable visual information for customers. The content in the infographics should be relevant to the product claim, personalized for your company, well-formatted, and be helpful in providing valuable information. A fun, quirky, easy to read design will make tedious claim processes easier for customers.

Chatbots

Elementary chatbots can be easily deployed to answer basic questions related to the claims process and claims status. Since a chatbot is an interactive tool, it provides a comfortable user experience. Chatbots can also make it easier for backend systems to create claim tickets and speed up the process of managing claims. They can be programmed to follow up on customer’s existing insurance claims as well and notify them about upcoming payments. The customer will have efficient and speedy service and ultimately a hassle-free experience.

AI Voice Assistance

Another technology trend insurers can deploy is an AI Voice Assistant. Having a 24/7 customer service hotline is not always feasible yet with this AI Voice Assistant, it is possible without comprising on the experience. It can be used in the insurance industry for processing claims, customer service and detecting fraud. Machine Learning methods can be used at different stages of the claim process. AI can assess the damage, report repair costs, sanction claims payment etc. based on data.

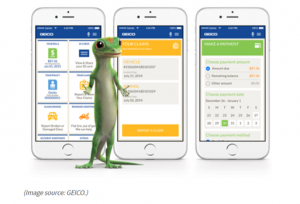

Kate by Geico is a digital assistant that answers policy questions for mobile app users. It makes it easier for the customer to have all the information regarding their claim process without having to contact a customer service centre.

FAQ pages and Forum

Having effective FAQs within a website is one of the richest sources of content and is also one of the easiest ways to cover a broad range of customer intent topics- transactional, informational, and locational. Over a course of time, you can use the insights from search traffic and social media listening, the type/pattern of queries customers have and convert them into well structure FAQs.

At FWD, we love developing solutions that solve simple customer queries effectively- whether that is through creative content or piece of technology. Get in touch with us, if you need the support in creating a compelling set of claims communications that stand out.