May 28, 2020 | 5 Min Read

CX takes centerstage within the new normal for insurers as generating new customers gets harder in the current economic climate and amidst the comms clutter of discounts and offers that may even sway existing loyal customers through the way.

Our series mind the gap, attempts to highlight crucial gaps that if fixed, could turn the tide for all the stakeholders.

Part 1- Give me the price first

As part of Customer Experience or CX strategy, organizations should build a mechanism to conduct continual inspection and analysis of the entire customer journey. This helps to map critical points where customer expectations can be higher than normal and address these with timely solutions.

One of the customer expectation high point is product pricing.

Search engines and social media channels typically being the platforms of discovery for customers, they are the first point of contact for new/existing customers, with the common customer journey path followed as:

Ad –> Content –> Social Media Post –> Lead Generation —> via form / messenger/ chat / call / message via bot/WhatsApp for Business.

For customers, the urgency in this phase is to understand if the price offered by the insurer is within their budget but unfortunately, getting to know the approximate pricing from an insurer seems to be as hard as inventing the COVID-19 vaccine! Forms with too many fields, questions that are not significant or price altering, 404 error after meticulously typing all required information, turns away customers towards easier, quicker options.

Insurance service providers tend to be pedantic about pricing to ensure its actuarially compliant, which is only fair, but there must be a way to meet the customers in the middle.

Some options that can be considered are:

1) Offer a pricing band– based on historical data for the type of query – offer an indicative price band for customers. Do not overwhelm the customers with too many questions or journey steps in the first instance.

2) Offer an integrated communication channel– if a customer has provided details via an email, lead form or social media, follow it up immediately by a call or a text/WhatsApp message with different price/ product options for the customer to choose from.

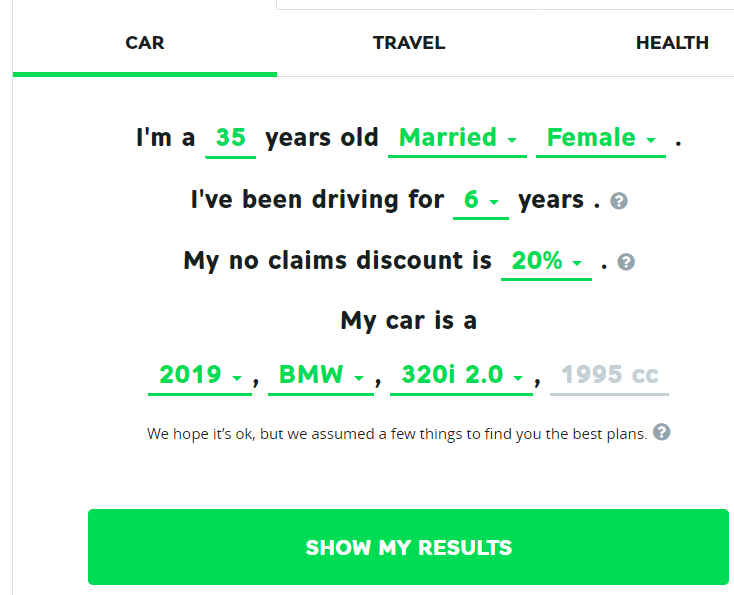

3) Develop an insurance premium calculator – if you have the capability to provide price band (as suggested in point 1), present that capability into a calculator from an experience perspective to maintain engagement.

Go Bear’s engaging form asks 9 data points in an engaging manner

4) Social media management– get your social media team to be briefed on how to manage pricing related queries effectively and in a timely manner without bogging down the customer with questions or template responses (i.e. asking them to fill the form)

By implementing innovative ways to meet the customer’s primary need whilst maintaining the underwriting principles, the insurance brand can truly lay the foundations towards lasting customer relationships.